Share Portfolio Manager for Google Sheets™

Built for serious Australian share traders who want full control, accuracy, and ATO-ready reporting.

Join hundreds of satisfied share traders

Track Every Trade with Precision and Clarity

Monitor your holdings, profits, and performance directly in Google Sheets™.

Automatically calculate capital gains, dividends, and portfolio returns, all while keeping your data private and under your control.

Premium Features

- Multiple Portfolios

- Multiple Currencies

- Currency Conversion

- Fractional Shares

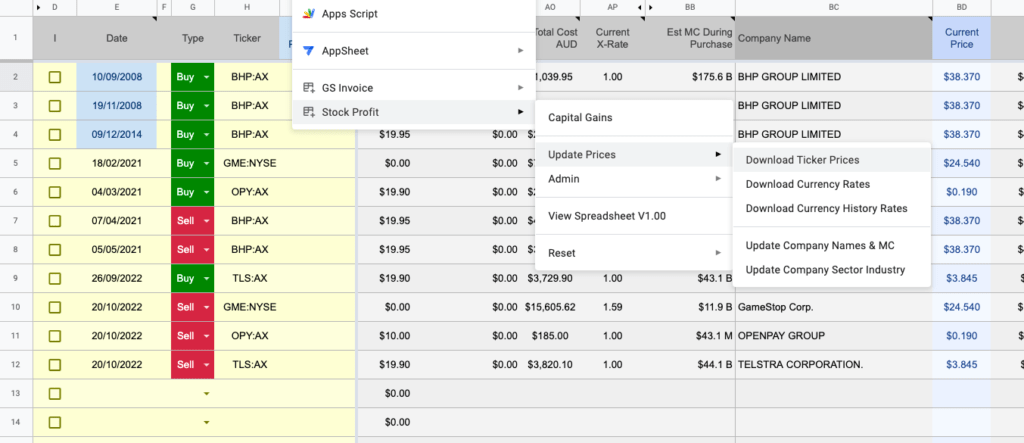

- Download Latest Ticker Prices

- Download Historical Currency Rates

- International Exchange Support

- Automatic & Manual Deferred Tax Calculation

- Stock Split Management

- Swing Trading

- Dividend Tracking

- Income Trust Tracking

- Basic Crypto Support

- CSV Transaction Importer

- Commsec

- Selfwealth

- Open Trader

- Stake Aus

- Stake US

- NabTrade

- IBKR

- Superhero

- Betashares

- And Much More!

Professional Capital Gains Calculator

- Accurate Capital Gains / Loss Calculator

- ATO Compliant

- Any Buy / Sell Combination (cross broker support)

- AMIT cost-base adjustments (Deferred Tax)

- FIFO

- LIFO

- Highest Profit

- Biggest Loss

- CGD trades with highest profit first

- CGD trades with lowest profit first

- Non – CGD trades with highest profit first

- Non – CGD trades with lowest profit first

- Multiple Tax Rate Support

- Individual

- Company

- SMSF

- Discretionary Trusts

Watch the quick introduction

Using Google Sheets™ you can manage your stock portfolio.

Understand exactly how your investments are performing with 20 minute delay price & currency updates, plus powerful reports and state of the art capital gains calculator.

Pricing:

Subscribe to Support

If you find Stock Profit useful, please consider subscribing to help with hosting and data costs.

Why Use a Stock Profit Calculator?

When trading shares, knowing your profit and loss (P&L) is essential. A stock profit calculator helps you:

- See your stock gains or losses.

- Work out capital gains tax implications.

- Track your buy and sell prices over time.

- Prepare a stock loss report for EOFY (end of financial year).

Instead of guessing, you’ll know exactly where your portfolio stands.

Share Tracking Spreadsheet for Australian Investors

Our downloadable share tracking spreadsheet is designed with the Australian share market in mind, but it can easily be adapted for other world markets. Our advanced spreadsheet includes:

- Stock gain / loss calculator: See your performance at a glance.

- Capital gains calculator for shares: Calculate taxable gains quickly.

- Shares profit calculator: Understand your returns per trade.

- Customisable formulas: Adjust it to suit your portfolio size and trading style.

This makes it the perfect share profit calculator for anyone trading ASX shares, ETFs, or even international stocks.

FAQs — Share Trading Spreadsheet

In our CGT Report, Unclaimed CGD (Capital Gains Discount) appears when losses are used to offset your profits. In these cases, the capital gains discount can’t be applied, so the unclaimed amount is highlighted in red on the spreadsheet.

This acts as a visual reminder and can help you explore whether a different capital gains calculation method may produce a better outcome.

For example, in the attached case, there are over $26k of unclaimed CGD. Using the 50% discount rule, this could translate into more than $13k in potential tax savings.

You need to be very careful here. The ATO specifically targets wash sales, which occur when you sell an asset purely to create a tax loss and then quickly repurchase the same (or substantially similar) asset.

What Happens if You Do This?

The ATO may decide the transaction was done only for tax benefits.

If so, they can:

Deny the capital loss claimed.

Impose penalties and interest.

What Counts as “Similar”?

Rebuying the exact same shares soon after selling almost always raises red flags.

Buying substantially identical investments (e.g. a different class of the same company’s shares, or an ETF tracking the same index) can also be caught.

Safer Alternatives

If your goal is portfolio management, consider:

Switching into a different company in the same sector.

Using an ETF or managed fund with a broader mix of holdings.

Make sure there is a genuine commercial reason for the sale, not just a tax benefit.

👉 In short: you can’t simply sell and rebuy the same stock to reduce tax: The ATO will likely treat this as a wash sale. But you can restructure your portfolio in ways that achieve both tax and investment goals, as long as it’s genuine.

Our calculations are extremely accurate, provided your data is entered correctly.

Stock Profit’s system is designed to be fully ATO-compliant and audit-ready. The formulas account for all Australian tax requirements, including cost-base adjustments, discount methods, and complex scenarios such as stock splits and bonus issues.

Yes! Stock Profit supports CSV imports from major Australian brokers including:

- Commsec

- Selfwealth

- Open Trader

- Stake Aus

- Stake US

- NabTrade

- IBKR

- Superhero

- Betashares

This eliminates manual data entry and reduces the risk of errors.

Absolutely. Stock Profit automatically converts foreign currencies using historical exchange rates, making it ideal for investors with international portfolios.

To give you the best outcome, our system applies the daily high rate for buys and the daily low rate for sells, ensuring your profit or loss isn’t overstated.

Prefer to use your own figures? No problem—you can enter your own currency conversion (including transfer fees) and add notes for tax purposes, which may be more beneficial depending on your situation.

All conversions are fully ATO-compliant for accurate tax reporting.